Articles

Usually, the actual property broker or any other people guilty of closing the newest purchase need declaration the newest product sales of the house on the Internal revenue service using Mode 1099-S. To find out more from the Form 1099-S, see the Guidelines to possess Function 1099-S plus the General Guidelines without a doubt Advice Productivity. The fresh agent’s (or substitute’s) accountability is limited on the payment the new broker (or substitute) gets on the transaction. In the event the a different shareholder within the an excellent locally managed QIE dumps a desire for the newest QIE within the an enthusiastic appropriate clean product sales exchange, unique laws pertain. Feeling of stock within the a REIT which is kept personally (otherwise ultimately as a result of no less than one partnerships) because of the an experienced stockholder might not be susceptible to withholding.

What is actually an excellent REIT?

You’re a withholding broker if you are a great You.S. or international person, in the any type of skill pretending, that has control, acknowledgment, child custody, discretion, or percentage out of an expense at the mercy of chapter step three withholding. An excellent withholding broker is generally an individual, business, partnership, believe, relationship, nominee (lower than part 1446), and other organization, and any overseas mediator, international partnership, otherwise U.S. branch away from certain international banking companies and you may insurance agencies. You are an excellent withholding broker even if there isn’t any specifications in order to keep back away from a payment if not in the event the another person have withheld the mandatory matter in the fee. TIN so you can allege a reduced rates out of withholding under a taxation treaty in case your conditions for the following exclusions try met. TIN from a foreign payee, you may also demand a foreign TIN awarded by the payee’s nation from household except when the payee are a nonresident alien individual claiming an exception away from withholding to your Form 8233. Which area demonstrates to you the principles for withholding tax away from purchase private functions.

Holiday rentals

- Withholding overseas partnerships and you can withholding foreign trusts are not move-because of entities.

- The existence of the fresh employer–staff relationships beneath the usual common-law regulations will be determined, inside doubtful times, by a study of the facts of each instance.

- This way, REITs stop using business income tax, while other programs is actually taxed to the profits to see whether or not and ways to distribute just after-tax payouts since the dividends.

- Faith ‘s the creator and you may bulk owner away from Charleston, South carolina-centered Greystar, that’s effective in the possessions and you will money management and you will home invention features.

An offer must also become a price that does not qualify because the a scholarship or fellowship. The fresh grantor cannot wish extent as made available to the newest grantee for the purpose of assisting the brand new grantee to do investigation, training, or research. You could potentially remove the brand new taxable part of a good U.S. source give or scholarship as the wages. The brand new scholar otherwise grantee need been accepted on the Joined States for the an “F,” “J,” “Meters,” otherwise “Q” visa. The newest pupil or grantee knows you are with this alternate withholding procedure once you request a form W-4. Most other royalties (for example, copyright laws, software, broadcasting, approval money) (Income Code twelve).

Special laws connect with determine if a different corporation’s USSGTI is actually effortlessly associated with an excellent You.S. change or business. Often, you need to withhold within the statutory regulations for the money designed to a great treaty country citizen builder to own features did in the United States. The reason being the standards about what the brand new treaty exemption are based is almost certainly not determinable until pursuing the romantic of your own tax season. The newest specialist have to following document an excellent U.S. tax go back (Mode 1040-NR) to recoup any overwithheld income tax giving the new Internal revenue service having evidence that they’re eligible to a great treaty different. Foreign experts that unlawful aliens is actually subject to U.S. taxation regardless of its illegal reputation.

You’re also our very own earliest priority.Each time.

Personal https://vogueplay.com/au/crystal-ball/ defense and Medicare taxes should not be withheld otherwise paid back on this count. While you are a person responsible for withholding, bookkeeping to have, or placing otherwise paying a job taxation, and you will willfully neglect to take action, you will be held responsible for a penalty equivalent to the fresh complete quantity of the fresh unpaid believe fund tax, in addition to focus. A responsible person for this function might be a police away from a firm, someone, a sole holder, otherwise an employee of every kind of team. An excellent trustee otherwise broker that have expert over the fund of your team can also be held accountable on the punishment. Businesses must create an expense to the wages away from a great nonresident alien employee solely with regards to figuring earnings income tax withholding.

We are able to let multiple physicians who had been turned into off in other places on the equipment has just. Enabling physicians getting higher than 10 yrs away from house but still meet the requirements has been beneficial to of many. The chance to offer one hundred% investment up to $1.5 million, and you will 95% funding as much as $dos million, and 90% investment up to $dos.5 million might have been strong compared to the competitors.

What’s the investment gains taxation to your a property?

Treatments for education loan costs inside the calculating loans so you can earnings rates is often of concern to help you medical professionals; however, we have been really versatile about how exactly i underwrite deferment and you may income founded installment. This choice is offered to People in the us, long lasting, and non-long lasting people. To the February 7, the new Company of the Treasury’s (Treasury) Monetary Crimes Administration System (FinCEN) launched a recommended laws designed to improve visibility in a few residential home transactions (the brand new Suggested Laws). The fresh Recommended Signal gets into a far more “sleek reporting structure” according to the new ANPRM and you will closes lacking demanding a house professionals to maintain anti-money laundering and countering the credit away from terrorism (AML/CFT) conformity software. Commercial as well as domestic a house involve leverage you to outmatches a number of investment. Yet not, industrial characteristics involve far more money and a lot more cutting-edge structures.

Treasury rolls away home-based home transparency legislation to battle money laundering

A duplicate of Setting 8805 per overseas spouse should also getting linked to Form 8804 when it is recorded. As well as install the most recent Mode 8804-C, mentioned before, for the Function 8805 filed to the partnership’s income tax 12 months inside the that the Setting 8804-C is felt. Less than section 1446(a), a partnership (overseas otherwise home-based) who may have earnings efficiently associated with a U.S. exchange otherwise company (otherwise earnings treated while the effectively linked) must pay a good withholding tax for the ECTI that is allocable to help you its international lovers. An openly traded partnership otherwise nominee for a publicly replaced connection shipment have to withhold taxation on the actual distributions from ECI. See In public Traded Connection Distributions (PTP Withdrawals), after. A great nonresident alien briefly in america on the an “F-step one,” “J-1,” “M-step one,” or “Q-1” visa isn’t susceptible to social shelter and you can Medicare fees for the pay for features performed to take care of the idea where the new alien is accepted to your Us.

The fresh beneficiaries otherwise owners, therefore, aren’t required to document says to possess refund to the Irs to find refunds, but instead will get see him or her on the WT. A great WT can get get a refund of taxation withheld less than part 4 for the the amount let beneath the WT agreement. A foreign people shouldn’t have to render a good You.S. otherwise foreign TIN to claim less price out of withholding under an excellent pact to have section 3 motives if your conditions to your after the conditions is actually fulfilled. In the event the an amount is actually a great withholdable commission and an amount subject to chapter step 3 withholding plus the withholding broker withholds lower than part cuatro, it could borrowing from the bank which matter facing people tax due below section step 3.

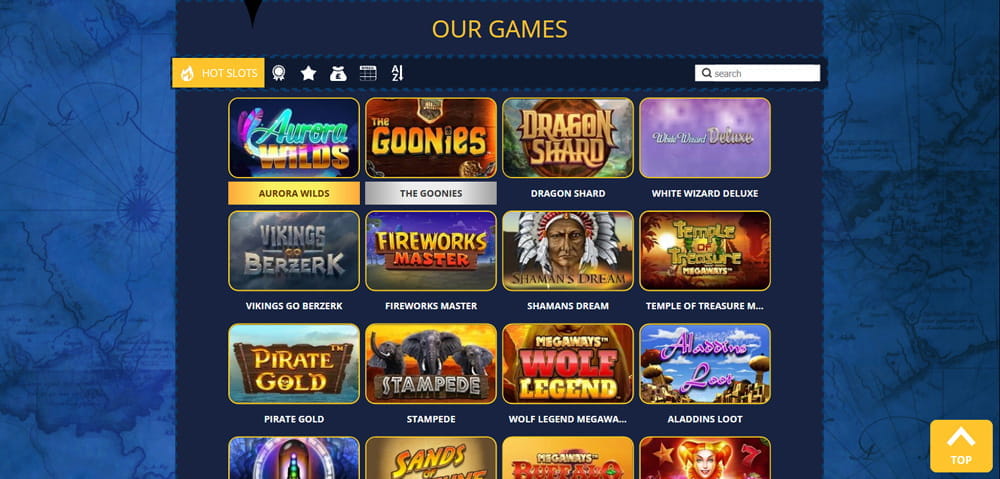

The working platform is the identical one to energies their sibling web site PartyPoker New jersey which is considered to be perhaps one of the most state-of-the-art on the market. It is quite really worth detailing your system integrates all the online casino games offered to BetMGM users inside the New jersey. The fact that BetMGM is so well-known amongst casino players mode industry is smooth than just in the PokerStars, that have more leisure professionals productive during the MGM Poker tables. For every casino poker variation is different and needs an insight into the brand new web based poker laws and regulations which can be type of to this games. While you are individuals may have played Texas holdem, they could not understand how Stud video game try worked or starred. The net software for the PokerStars Nj-new jersey makes it simple — people don’t need to worry about anteing as it’s over automatically — so it makes it a great location to learn the newest combined video game versions.

Come sempre in anticipo sulla normativa,

Come sempre in anticipo sulla normativa,

Le nuove proposte immobiliari di

Le nuove proposte immobiliari di