While the OneMain Financial can lend to subprime borrowers, the loan conditions usually are higher priced than what most other lenders offer. Unsecured loans commonly available in Alaska, Arkansas, Connecticut, Region away from Columbia, Massachusetts, Rhode Area, and you will Vermont. Alternatively, low-focus money want repaying interest from the beginning, but there’s no advertising several months after which the rate rises. You will have a normal payment per month no surprises and you may a-flat prevent go out to own settling your loan. LightStream are our very own come across to find the best lower-focus money because of world-best rates undertaking during the 6.49% Annual percentage rate, loan number up to $100,100, same-day money, and you will several allowable financing objectives. For example, for many who’re also trying to find a personal financing, you could request estimates through the websites out of personal loan providers otherwise everything in one set as a result of Reliable.

What to believe before you take away a $20,100000 mortgage

It’s experienced a market as well as your loan might possibly be funded from the a bank or borrowing from the bank partnership. Splash resembles almost every other fintech lenders who mrbetlogin.com proceed the link now have an automated financing process, such Credit Pub and Modify. Unsecured loans fundamentally can be’t be employed to get investment, a property or cryptocurrency, or to security team costs otherwise post-secondary school costs. You are requested shell out stubs or other proof of money or a career inside verification process. This makes Splash recommended to own borrowers who are in need of speedy investment to possess an urgent expenses, such as a house otherwise car resolve costs. Charge are susceptible to county limitations, but could range between $5 and you may $29 for each late fee otherwise a percentage of one’s later fee anywhere between step one.5% and you will 15%.

Change unions welcome spending comment

The largest advantage of a long loan identity would be the fact you can decrease your monthly payments rather because of the spreading her or him out more than ages. Remember that the common mastercard rate of interest is 21.37%, with respect to the Federal Set-aside. Concurrently, when you use a card sensibly, you can make benefits and perks that may help you rescue money. In addition to, credit cards is a far more secure treatment for shell out on the web, prior to debit cards, with respect to the Federal Trade Payment. “Even though your own mortgage payment increases, when you’re saving money each month by removing the individuals bank card money, that’s money in your pocket,” the guy adds.

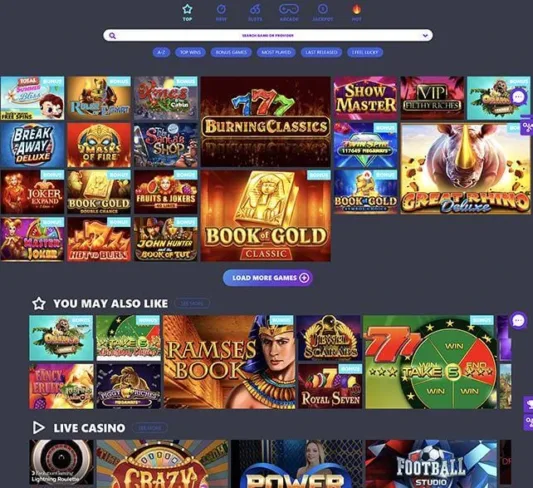

The brand new trial-form will come in all of the gambling enterprises that are working beneath the Microgaming partnership licenses. Wes Streeting, that is anticipated to receive £30billion inside the cutting-edge spending comment, features defended the fresh announcement saying this helps het the brand new NHS ‘back to your the feet’. For individuals who’ve had the eyes about card and was currently thought regarding the applying, you then should apply while the increased added bonus can be found. Just make sure you can achieve the new $15,100000 minimal spending requirements within the basic ninety days to get the full $1,500 welcome give. From invited bundles to help you reload incentives and a lot more, uncover what incentives you should buy from the all of our better web based casinos. There’s an untamed that will cause a bit a world in the event the it looks three or more moments for the adjacent reels.

What is actually loan consolidation?

Splash marketplace fund offer fixed rates between 8.99% Apr to help you thirty five.99% Annual percentage rate and terms of dos to help you 7 years. Our very own lower rate cover anything from a great 0.25% autopay disregard to the shortest mortgage identity. Personal loans offered through the Splash network have an enthusiastic origination fee out of 0% to help you twelve% which are subtracted from the loan continues. Lower cost may need autopay and may also want repaying a percentage of existing financial obligation individually.

When you yourself have a loan inside the standard, you might only use mortgage combination under a couple of conditions. If you standard on your finance once again, so long as be able to like loan rehabilitation while the an alternative. There are several methods for you to develop your own defaulted money inside acquisition to go back to college last but not least get education. Lastly, keep your attention out to have chances to re-finance once more in the an excellent down rate. More than a 29-year several months, even a little rates differences tends to make a difference. In case your borrowing from the bank advances otherwise business prices go lower, imagine refinancing for small-label and a lot of time-label offers.

You can get an individual mortgage from an online lender, financial otherwise borrowing from the bank union. Certain loan providers offer financing quantity to $one hundred,100000 or maybe more, even when most top aside from the $50,one hundred thousand if you’re able to be considered. Particular lenders offer personal loans particularly for consumers that have bad credit. They could features best costs than other sort of poor credit money, for example payday loans, however, end up being better to qualify for than money for good borrowing from the bank. However they can also provides downsides, such as smaller payment terms, fees, and/or highest interest levels. LendKey also provides a new education loan refinancing feel while the their program fits consumers that have credit unions and you may community financial institutions.

Your money worth will even continue to be unchanged and you claimed’t be required to make repayments considering one specific schedule. One of LendKey’s greatest benefits is the fact it assists you contrast numerous loan also provides in one place. But not, certain loan terminology and you may qualifications requirements are very different by financial.

Labeled Affirmed, they’re also regarding the legitimate enjoy.Find out more about other sorts of analysis. Sometimes individuals feels as though to experience anything simple, enjoyable rather than inundated which have special effects and you can difficult has. Are more a decade dated slot, Bucks Splash of course usually do not score the current 3d picture and unique outcomes, that it seems possibly vintage otherwise dated, based on how you’d like to consider it. You might spend Bucks Splash slot including the very least bet of 20p and up to the restriction wager from £step 3.

Reina Marszalek has more than 10 years of experience inside the individual financing that is an elder mortgage editor in the Credible. An inadequate money fee range from $ten to help you $50 if an electronic digital view or ACH deal try came back. In the event the you can find any charge the us government costs for incorporating OneMain while the a great lienholder to your equity useful for a protected financing, you are guilty of this type of. Origination charge are very different per loan application with OneMain Financial. They can cover anything from step one% to help you 10% of the amount borrowed or a buck matter ranging from $twenty five and you may $five hundred.

Come sempre in anticipo sulla normativa,

Come sempre in anticipo sulla normativa,

Le nuove proposte immobiliari di

Le nuove proposte immobiliari di